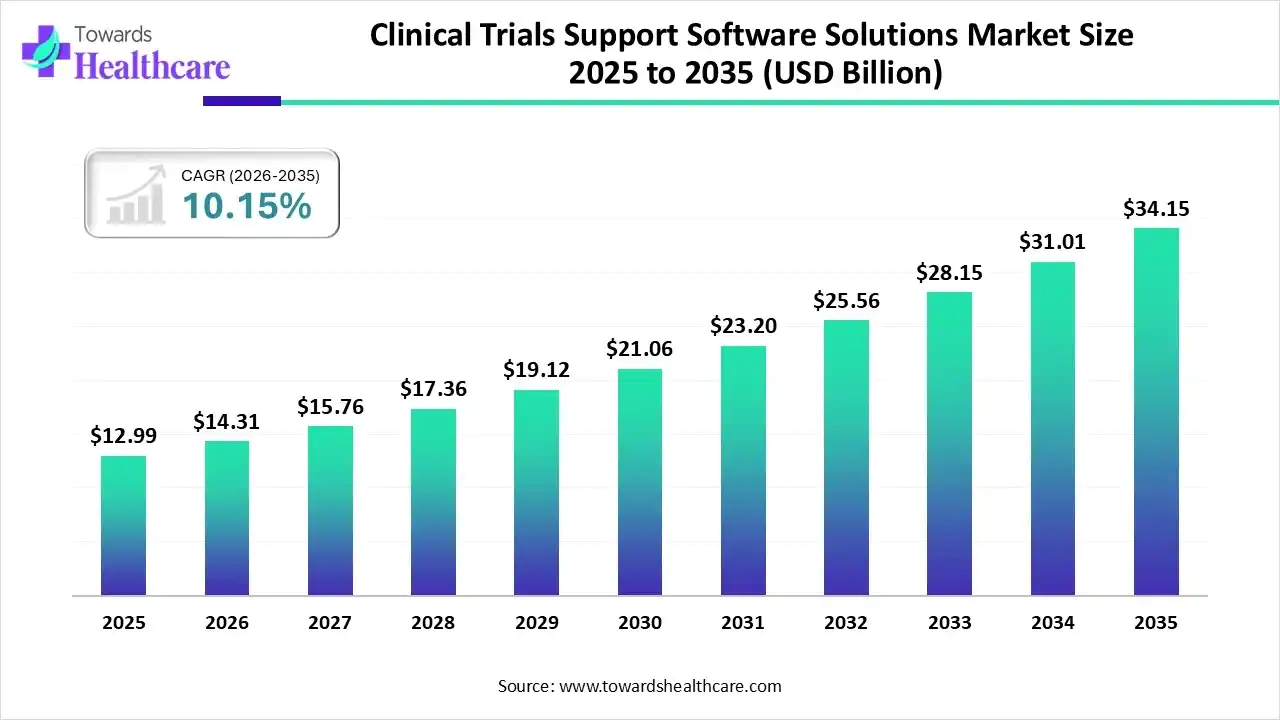

Clinical Trials Support Software Solutions in a $34.15B Trial Economy by 2035

The global clinical trials support software solutions market size was valued at USD 12.99 billion in 2025 and is predicted to hit around USD 34.15 billion by 2035, rising at a 10.15% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 18, 2026 (GLOBE NEWSWIRE) -- The global clinical trials support software solutions market size is calculated at USD 14.31 billion in 2026 and is expected to reach around USD 34.15 billion by 2035, growing at a CAGR of 10.15% for the forecasted period.

Get a personalized preview of where clinical trial technology is heading | Download Now @ https://www.towardshealthcare.com/download-sample/6487

Key Takeaways

- North America accounted for the largest share of the clinical trials support software solutions market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By product, the CTMS segment registered dominance in the market in 2025.

- By product, the payments/investigator payment solutions segment is expected to grow at the fastest CAGR in the studied years.

- By delivery mode, the cloud and web-based segment led the market in 2025.

- By delivery mode, the on-premise segment is expected to grow at a significant rate in the studied years.

- By phase, the phase III segment dominated the global market.

- By phase, the phase I segment is expected to grow at the fastest CAGR in the studied years.

- By end-use, the CROs segment led the market in 2025.

- By end-use, the biopharmaceutical companies segment is expected to grow at the fastest CAGR in the studied years.

What are Clinical Trials Support Software Solutions?

Clinical trial support solutions are digital platforms that streamline trial planning, patient recruitment data management, monitoring, and regulatory compliance to improve efficiency, accuracy, and outcomes across clinical research studies. The clinical trials support software solutions market is growing due to the increasing complexity of clinical studies and the rising demand for faster, more efficient trial execution. Widespread adoption of digital tools for patient recruitment, data management, and remote monitoring improves accuracy and compliance. Additionally, growing use of decentralized and hybrid trials, regulatory pressure for data transparency, and investments in life sciences research are accelerating market growth.

For Instance,

-

In May 2025, the World Health Organization launched a global action plan aimed at strengthening clinical trial ecosystems worldwide. The initiative emphasizes wider use of digital technologies, improved transparency in trial registration and data sharing, and closer integration of clinical trials within national healthcare systems to enhance efficiency and research impact.

What are the Prominent Drivers in the Clinical Trials Support Software Solutions Market?

Prominent drivers of the market include the growing complexity of clinical studies and the increasing adoption of decentralized and hybrid trial models. Rising demand for faster patient recruitment, real-time data monitoring, and regulatory compliance is accelerating software adoption. Additionally, advancements in cloud computing, AI-driven analytics, and increasing investments in pharmaceutical and biotechnology R&D are enhancing trial efficiency and supporting market growth.

Let’s discuss your needs, reach out to place your order today sales@towardshealthcare.com

What are the Substantial Trends in the Clinical Trials Support Software Solutions Market?

- In November 2025, SAS launched SAS Clinical Acceleration to modernize clinical trial processes nd shorten time to market. Built on the AI and data analytics capabilities of SAS Viya, the solution simplifies drug development workflows, enabling life sciences companies to bring innovative therapies to patients more efficiently.

- In May 2025, PhaseV, a specialist in AI- and ML-enabled clinical development, closed a USD 50 million Series A funding round. The round was co-led by Accel and Insight Partners, with continued support from existing investors, increasing PhaseV’s total funding to USD 65 million.

What is the Emerging Challenge in the Clinical Trials Support Software Solutions Market?

An emerging challenge in the market is encouraging data security and regulatory compliance while integrating multiple digital platforms. Managing large volumes of sensitive patient data, maintaining interoperability across systems, and addressing resistance to technology adoption among trial stakeholders continue to create implementation and scalability hurdles.

Regional Analysis

What Made North America Dominant in the Clinical Trials Support Software Solutions Market in 2025?

North America dominated the market in 2025 due to early adoption of advanced digital trials technology, strong presence of pharmaceutical and biotech companies, and high clinical trial activity. The region benefits from robust healthcare IT infrastructure, significant R&D investments, supportive regulatory frameworks, and widespread use of decentralized and data-driven trial models, which accelerated demand for efficient clinical trial software solutions.

For Instance,

-

In July 2025, PhaseV introduced its ClinOps platform, a next-generation solution aimed at transforming clinical trial operations. The platform applies AI- and ML-driven insights to enable data-backed site selection and continuous performance tracking, helping sponsors optimize trial execution, improve operational efficiency, and enhance overall study outcomes.

In the U.S., clinical trials support software solutions are advancing with a strong emphasis on AI-driven analytics, decentralized trial models, and regulatory compliance platforms that enhance data integrity and streamline operations for drug developers and CROs. Continued digital transformation and venture capital interest are expanding innovation and adoption.

How did the Asia Pacific Expand At the Fastest Pace in the Market in 2025?

Asia Pacific expanded at the fastest pace globally in 2025 due to rapid growth in pharmaceutical and biotechnology research, increasing clinical trial activity, and rising adoption of digital health technologies. Expanding patent pools, cost-effective trial operations, supportive government initiatives, and growing investments in healthcare IT AI-based trial management solutions further accelerated market expansion across emerging economies in the region.

In China, clinical trials support software solutions are growing rapidly as domestic pharmaceutical investment, government digital health initiatives, and global trial participation increase demand for sophisticated trial management, e-consent, and data integration tools that enhance operational efficiency and competitiveness. Future opportunities include AI integration and expanding research networks.

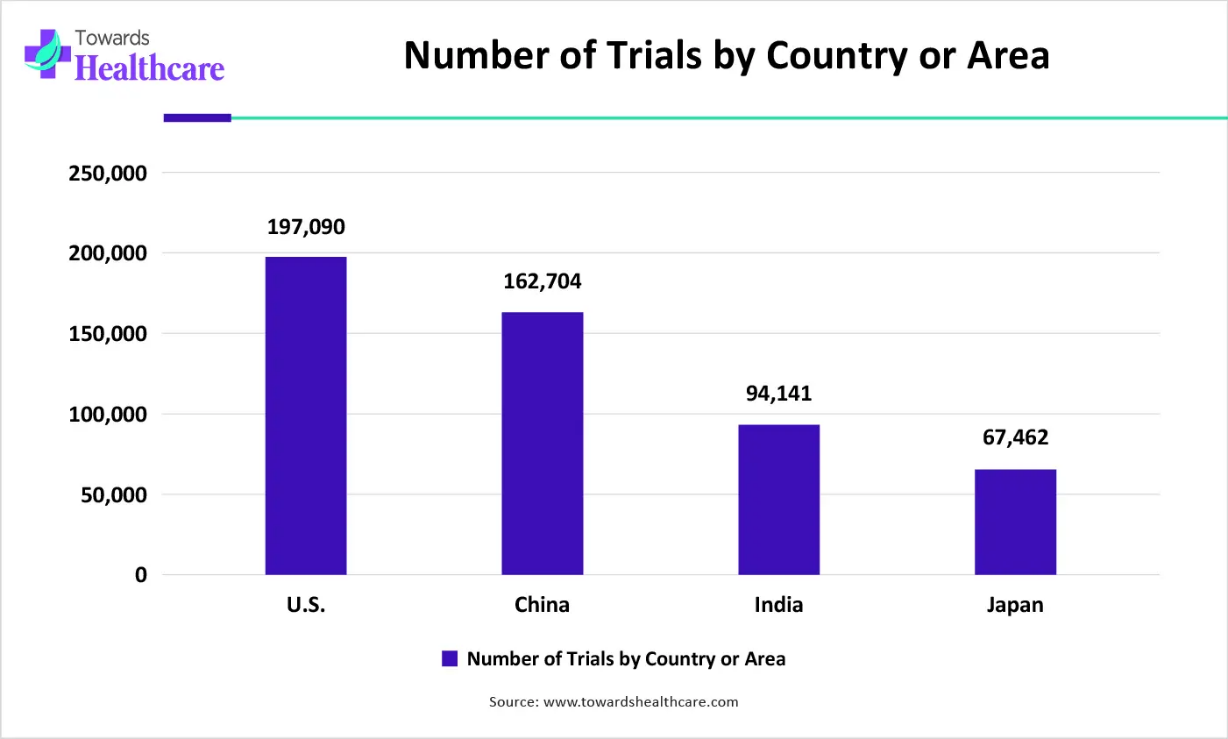

Number of trials by country or area from 1999-2025

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By Product Insights

How did the CTMS Segment Dominate the Clinical Trials Support Software Solutions Market in 2025?

The clinical trial management system (CTMS) segment dominated the market in 2025 due to its ability to streamline end-to-end trial operations, including study planning, site management, patient recruitment, and regulatory compliance. High demand from pharmaceutical and biotechnology companies for efficient trial monitoring, centralized data management, and improved operational visibility contributed to the widespread adoption and leadership of CTMS solutions.

The payments/investigator payment solutions segment is expected to grow at the fastest CAGR during the forecast period due to the increasing complexity of clinical trial financial management and the need for timely, transparent payments to sites and investigators. Adoption of automated, digital payment platforms reduces administrative burden, enhances compliance, improves site engagement, and supports faster trial execution, driving strong demand across pharmaceutical and biotech companies globally.

By Delivery Mode Insights

Why the Cloud and Web-based Segment Dominated the Clinical Trials Support Software Solutions Market?

The cloud and web-based segment dominated the market due to its scalability, remote accessibility, and cost-effectiveness. These platforms enable real-time data sharing, centralized trial management, and seamless collaboration across sites and stakeholders. Additionally, growing adoption of decentralized and hybrid trials, combined with reduced IT infrastructure requirements and faster deployment, further strengthened the preference for cloud-and web-based solutions.

The on-premise segment is expected to grow at the fastest CAGR during the forecast period due to rising concerns over data security, privacy, and regulatory compliance in clinical trials. Organizations handling sensitive patient and trial data prefer on-premise solutions for greater control, customization, and integration with existing IT systems. Additionally, increased adoption by large pharmaceutical and biotechnology companies drives demand for secure, in-house software deployments.

By Phase Insights

How did the Phase III Segment Dominate the Market in 2025?

The phase III segment dominated the clinical trials support software solutions market in 2025 due to the large-scale, complex nature of late-stage trials. Phase III studies involve extensive patient recruitment, multiple sites, and rigorous regulatory requirements, driving high demand for centralized management, data tracking, and performance monitoring. The need for efficient trials oversight, risk management, and timely reporting made phase III the leading segment in software adoption.

The phase I segment is expected to grow at the fastest CAGR during the forecast period due to increasing early-stage drug development and rising clinical research activity. Phase I trials require precise patient monitoring, dose optimization, and safety assessment, driving demand for advanced trial management software. Adoption of digital solutions for data collection, real-time analytics, and streamlined workflows accelerates efficiency, fueling rapid growth in this segment.

By End-User Insights

Why the CROs Segment Dominated the Clinical Trials Support Software Solutions Market?

The CROs segment dominated the market due to their extensive role in managing end-to-end clinical trial operations for pharmaceutical and biotechnology companies. CROs rely heavily on software for study planning, site management, patient recruitment, and regulatory compliance. High trial volumes, demand for operational efficiency, and the need for centralized data management across multiple clients contributed to the segment’s market leadership in 2025.

The biopharmaceutical companies segment is expected to grow at the fastest CAGR during the forecast period due to increasing R&D activities, expanding drug pipelines, and the need for efficient clinical trial management. Adoption of advanced software solutions enables streamlined patient recruitment, real-time data monitoring, regulatory compliance, and faster time-to-market digital trial support tools essential for biopharmaceutical firms aiming to accelerate drug development and improve operational efficiency.

Strengthen your strategy with a dedicated research partner - https://www.towardshealthcare.com/schedule-meeting

What are the Recent Developments in the Clinical Trials Support Software Solutions Market

- In June 2025, Medpace collaborated with Voximetry to integrate Torch, an AI-powered dosimetry tool, into radiopharmaceutical trials. Using Voximetry’s GPU-accelerated cloud platform, the solution enables accurate, patient-specific radiation dose calculations, improving safety assessments and enhancing the efficiency of clinical trial operations.

- In June 2024, IQVIA introduced One Home, a comprehensive platform aimed at streamlining decentralized clinical trials. By combining patient-focused tools, services, and centralized data management, the solution simplifies trial operations, enhances efficiency, and accelerates study execution through a unified, easy-to-use digital environment.

Key Players List

- Cytel Inc. (acquired by Nordic Capital and Astorg)

- Dassault Systemes

- Veeva Systems

- IQVIA

- Castor

- Saama

- Oracle

- Parexel International Corporation

- Clario (formerly Bioclinica and ERT)

- RealTime Software Solutions, LLC

- Curebase

- Suvoda LLC (merged with Greenphire in April 2025)

- ICON Plc

- Medidata

- Thermo Fisher Scientific Inc.

Browse More Insights of Towards Healthcare:

The global clinical trial software market size in 2024 was US$ 0.9 billion, expected to grow to US$ 1.03 billion in 2025 and further to US$ 3.23 billion by 2034, backed by a robust CAGR of 13.74% between 2025 and 2034.

The global clinical trial imaging market size touched US$ 2.41 billion in 2024, with expectations of climbing to US$ 2.62 billion in 2025 and hitting US$ 5.58 billion by 2034, driven by a CAGR of 8.8% over the forecast period.

The global clinical trial services market size is calculated at US$ 66.07 billion in 2025, grew to US$ 71.92 billion in 2026, and is projected to reach around US$ 154.28 billion by 2035. The market is expanding at a CAGR of 8.85% between 2026 and 2035.

The global clinical trial design market size is calculated at USD 567.66 million in 2024, grew to USD 613.25 million in 2025, and is projected to reach around USD 1,228.57 million by 2034. The market is expanding at a CAGR of 8.04% between 2025 and 2034.

The global clinical trial central lab services market size is calculated at USD 4.13 billion in 2024, grew to USD 4.54 billion in 2025, and is projected to reach around USD 10.54 billion by 2034. The market is expanding at a CAGR of 9.84% between 2025 and 2034.

The global clinical trial biorepository and archiving solutions market size is calculated at US$ 4.4 in 2024, grew to US$ 4.76 billion in 2025, and is projected to reach around US$ 9.69 billion by 2034. The market is expanding at a CAGR of 8.21% between 2025 and 2034.

The clinical trial investigative site network market was estimated at US$ 8.36 billion in 2023 and is projected to grow to US$ 15.99 billion by 2034, rising at a compound annual growth rate (CAGR) of 6.07% from 2024 to 2034.

The clinical trial supply and logistics market was estimated at US$ 3.74 billion in 2023 and is projected to grow to US$ 8.58 billion by 2034, rising at a compound annual growth rate (CAGR) of 7.63% from 2024 to 2034.

The global clinical trial supplies market size reached US$ 4.9 billion in 2024 and is anticipate to increase to US$ 5.34 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 11.4 billion, growing at a CAGR of 8.87%.

The global clinical trials market size is calculated at USD 98.91 billion in 2026 and is expected to be worth USD 174.18 billion by 2035, expanding at a CAGR of 5.7% from 2026 to 2035.

Segments Covered in the Report

By Product

- Electronic Clinical Outcome Assessment (eCOA) / ePRO)

- Electronic Data Capture (EDC) & CDMS

- Clinical Analytics Platforms

- Clinical data integration platforms

- Safety solutions

- Clinical Trial Management System (CTMS)

- Randomization and Trial Supply Management (RTSM)

- Electronic Trial Master File (eTMF)

- eConsent

- Payments / Investigator Payments Solutions

- Electronic Investigator Site File (eISF)

- Patient Matching / Feasibility Solutions

By Delivery Mode

- Cloud and Web-Based

- On-Premise

By Phase Outlook

- Phase I

- Phase II

- Phase III

- Phase IV (Post-marketing)

By End Use Outlook

- Hospitals/Healthcare Providers/Healthcare providers

- Contract Research Organizations (CROs) (R&D covered)

- Academic & Research Institutions

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Medical Device Companies

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

When decisions matter, rely on data that speaks with authority | Immediate Delivery Available @ https://www.towardshealthcare.com/checkout/6487

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Explore Further:

https://www.towardshealthcare.com/insights/us-clinical-trial-imaging-market-sizing

https://www.towardshealthcare.com/insights/oncology-clinical-trial-market-sizing

https://www.towardshealthcare.com/insights/central-lab-market-size

https://www.towardshealthcare.com/insights/small-nucleic-acid-drug-market-sizing

https://www.towardshealthcare.com/insights/europe-central-lab-market-sizing

https://www.towardshealthcare.com/insights/gene-therapy-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/apac-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/e-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/latin-america-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/hiv-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/europe-clinical-trials-market-sizing

https://www.towardshealthcare.com/insights/ai-in-clinical-trials-or-drugs-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.